Kuba Danecki

-

Nov 21, 2024

-

11 min read

What is UX in banking?

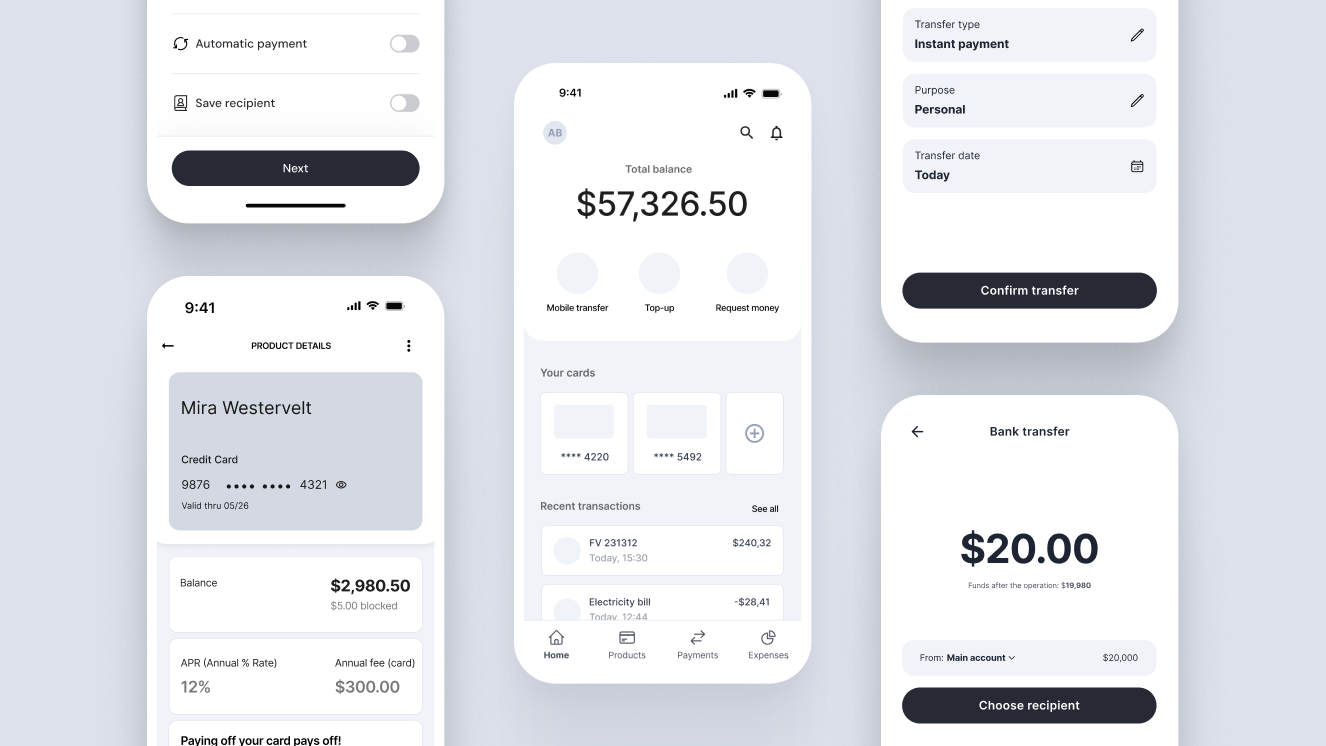

UX in banking refers to the way that customers interact with a bank's digital products, services, and digital ecosystem, and their overall satisfaction with those experiences. Learn about your users and consider how they would prefer to engage with features like checking account balances, making payments, and transferring money – after all, these are the core functions of banking apps. A good banking UX should be easy to use, convenient, and secure, allowing customers to complete their tasks efficiently.

Now, let’s get straight into the best practices for creating your own banking app.

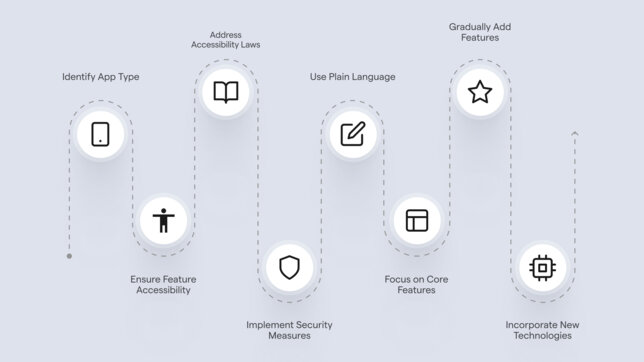

Pick your strategy

Before you dive into the designing phase, you have to decide what type of banking app you want to develop. There is a huge difference between traditional banks, which provide a wide range of services, and neo-banks, which focus on easy daily banking.

This touches both brand strategy and UX. There are many benefits to being perceived as a traditional finance institution with payments, currency exchange, investments, and other financial services within the mobile app. However, light and fast daily banking is easy on the user's mind.

Make things easy to find

It's no secret that banking apps offer a wide range of features for their clients, and these features continue to expand every year. So, what should be your top priority?

— Natalia Sidor, UX Design Manager

Remember that there are hundreds of features, and it’s hard to estimate which are actually important to most of your users. However, a combination of research, A/B testing and well-structured design can lead to an app that meets most users’ needs. Constant testing and improvement are the keys to user satisfaction.

Remember about accessibility

Accessibility in Europe has shifted from being a trend to an essential requirement, particularly for banks. This change is largely due to the implementation of the European Accessibility Act, which mandates that accessibility must be a core component of every banking app. As a result, financial institutions must now adapt to these new legal standards.

Accessibility is often associated with designing for individuals with disabilities. However, accessibility in banking involves much more than making your app user-friendly for everyone. It involves designing for diverse groups of people and adapting your app to various cultures and local differences in different countries.

— Natalia Sidor, UX Design Manager

Secure your app

A well-designed app prioritises user safety, and this is especially critical for banking apps. Users rely on these apps to create accounts, make transfers, manage investments, and store savings – all in one place. Therefore, it is essential to ensure the highest level of security.

To begin with, implement easy and secure login options. Today, numerous security features are available, such as biometrics, Personal Identification Numbers (PINs), and authorisation within the app. However, security doesn't stop at login; it's just the starting point.

The next crucial step is to secure the process of transferring funds. Essentially, every feature that involves users' personal information should be safeguarded as much as possible. By doing so, you will enhance user engagement and the overall digital experience.

Use plain language

While the design, features, security, and overall layout of your app are crucial, it’s also important to take care of the writing part of your future app – namely, use plain language.

— Piotr Dudziński, Senior UX Writer

Focus on making all other content in your app easy to read and understand. Understand your users and communicate with them in a way that is easy for them to understand, not you to write.

If you would like to learn more about UX writing and how to leverage it to your advantage, check out our article, where we discuss what it is and show the rules of effective UX writing.

Focus on the basic features first

Many banking apps now include features beyond traditional banking tasks, such as purchasing public transport tickets and paying for car parking. It enhances accessibility and eliminates the need for users to download multiple apps to perform these actions. However, it's important to strike a balance when adding features to your app.

— Piotr Dudziński, Senior UX Writer

Therefore, it's crucial to be cautious and avoid overwhelming the app with too many new elements at once. In many markets, super apps are becoming the standard. However, creating them should not be based on simply adding features. A balance needs to be struck.

Remember, Rome wasn’t built in a day, and neither should your app be. Avoid the temptation to incorporate every feature you think of all at once. Take your time and focus on the essential features first. It's crucial to ensure that fundamental functions, such as funds transfer, work seamlessly. If users encounter issues with basic features while other, less critical ones function correctly, they may quickly turn to competitors. The best approach is to implement additional features gradually. Once the core functionalities are polished and running smoothly, you can start adding other features one at a time.

Implement new technologies

The banking sector evolves relatively slowly compared to other industries due to regulatory requirements, for example. However, numerous innovative features related to payment methods, fund analysis, investment options, and more are available outside of the traditional sector. Therefore, it is crucial to ensure that your app incorporates at least some of these new features.

For instance, in Poland, many people cannot imagine a banking app without BLIK, a quick payment method that allows users to make payments anywhere using a code from their app, even at a distance. Similar quick payment options may involve using QR codes, as in The Netherlands, where iDeal rules.

— Natalia Sidor, UX Design Manager

When considering in-app functionalities, focus on how to make it easier for people to invest and manage their money effectively. For instance, you could allow users to create their own piggy banks with specific financial goals. Your app can automatically send a percentage of your users' income to the savings account. A feature that users are increasingly requesting is subscription management. The problem arises when they accumulate too many subscriptions and forget about them, leading to unexpected deductions from accounts. To simplify this issue, banks implement a subscription management option, as people have their subscriptions linked to a single card.

The potential features for your banking app are virtually limitless, offering a chance to develop innovative solutions that can enhance the banking app experience. It’s important to remember that the world is constantly evolving, so staying up to date with these changes is crucial.

Summary

Building your own banking app is a significant challenge, requiring careful consideration of many different factors from the outset. Before diving into the design phase, it's essential to outline every step of the process. This approach will help you clearly understand what needs to be done next and provide an overview of your project's progress.

Additionally, avoid moving on to the next step until you have fully completed the previous one. Ensure that each step is polished, and if you encounter any issues, address them immediately, if possible.

If you need any help in developing or enhancing your banking app, don’t hesitate to send us a message with a description of your potential project.